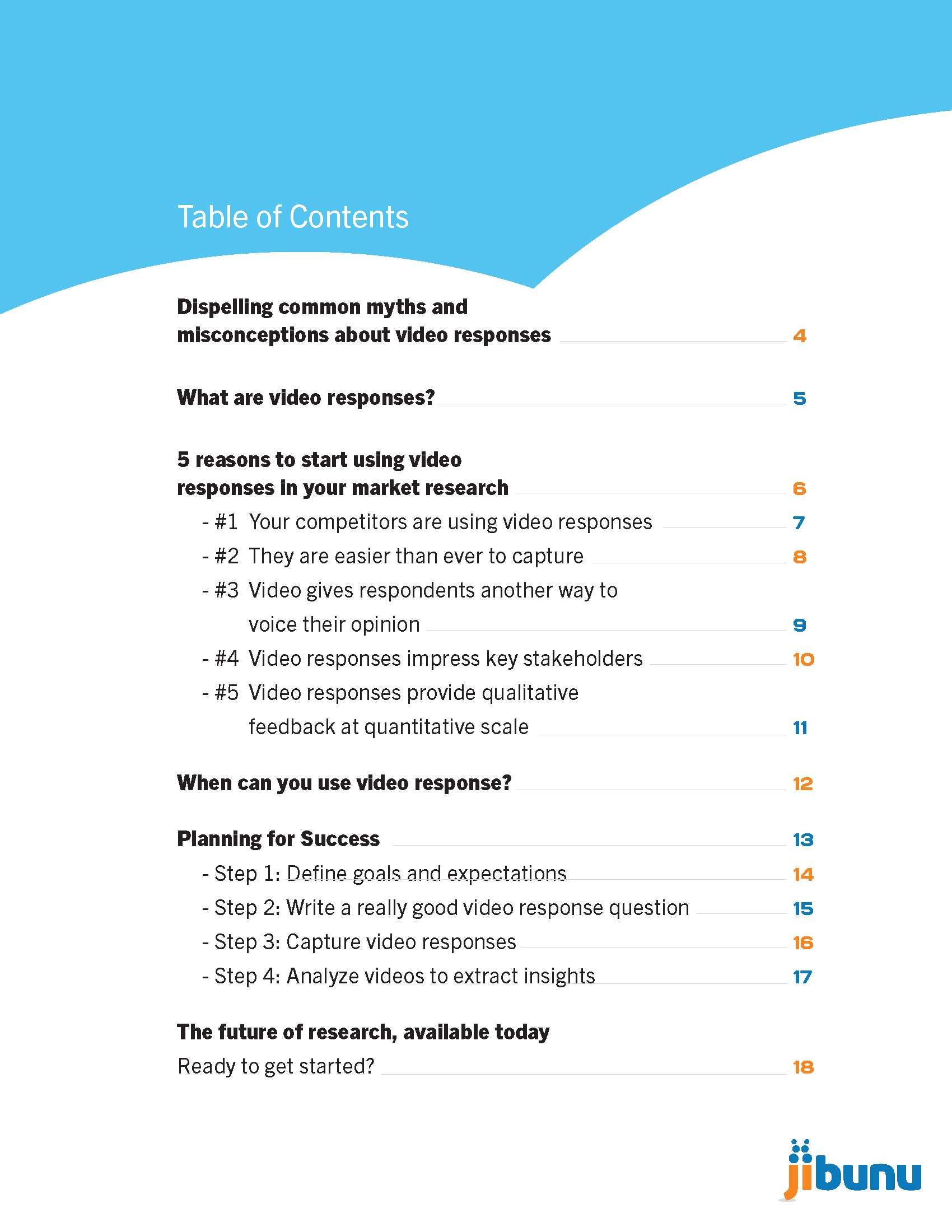

This eBook will take a look at using open-ended video responses in market research. More specifically, it will highlight many benefits of this technology and the steps needed to implement it.

This eBook will take a look at using open-ended video responses in market research. More specifically, it will highlight many benefits of this technology and the steps needed to implement it.

Quick Links

Address

310 Authority Drive

Fitchburg, MA 01420

Quick Links

Phone

978-537-5510

info@jibunu.com

Copyright 2024 Jibunu. All Rights Reserved.

Privacy Policy